- Nearly half of drivers already pay monthly subscription for automotive digital services

- OEMs say predictive maintenance, enhanced safety features and autonomous driving features most likely to drive recurring revenue

- OEMs view interfaces APIs, digital sims and infotainment systems areas at risk of hacking

DUBLIN–(BUSINESS WIRE)–Research from Cubic³, a global leader in software-defined vehicle (SDV) solutions, emphasises the opportunities and challenges facing automotive OEMs as they persuade drivers to buy and subscribe to in-vehicle digital services, such as predictive maintenance, safety features and autonomous driving.

Boston Consulting Group forecasts the software-defined vehicle (SDV) market will create over $650 billion value potential by 2030. The survey of 8,000 consumers (equally split between the US, UK, Germany and Japan) and 60 global OEM executives finds that the challenge for OEMs is how to persuade and prove to drivers the benefits of paying for digital services, which constitute an integral part of SDVs and thereby turning this forecast into reality.

Perceptions of Paying for Digital Services

The research shows current consumer willingness to pay for in-car digital subscriptions is likely to increase. 1 in 4 (25%) consumers have paid for digital services for their vehicles, almost doubling (44%) for those in the 18-24 age range. Only 1 in 5 consumers globally said they wouldn’t be willing to pay anything in monthly subscriptions.

Automakers estimate drivers are willing to pay $11 a month for digital services, while drivers say it’s $7.70 – a 30% difference. However, in countries where car usage is higher, the willingness to pay increases. For example, American respondents report they are willing to pay the most at $8.52 a month.

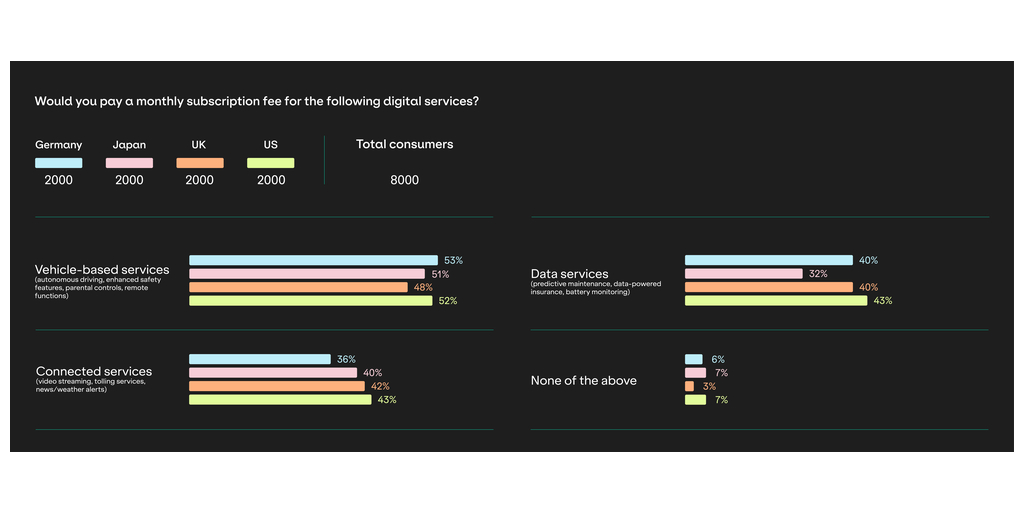

The survey grouped digital services into three categories to reveal consumer willingness to pay for each group. Nearly half (51%) of consumers are willing to pay for ‘vehicle-based services’, such as autonomous driving. Globally 40% of consumers are willing to pay for ‘connected services,’ such as video and music streaming, and 39% are willing to pay for ‘data services,’ such as predictive maintenance.

OEMs need to both monetise digital services and turn them into recurring revenue streams. Automakers think predictive maintenance, enhanced safety features, and autonomous driving are most likely to contribute the most to recurring revenue.

“Until recently, most consumers viewed buying a car as a ‘one-and-done’ affair. Although the concept of paying for in-car digital services is relatively new, we are already seeing significant adoption from consumers,” says David Kelly, Chief Corporate Officer, Cubic³. “It will take time for OEMs to persuade the public of the value of digital services, but it is encouraging to see younger drivers – so called digital natives – happy to pay for these services.»

OEMs (Mostly) Share Driver Concerns Over Cybersecurity and Data Privacy

Consumers are concerned about industry practices around data, with half (Global: 48%) reporting they worry their car could be hacked. Fortunately, OEMs hold automotive cybersecurity in high regard. 86% report that cybersecurity of their digital services is important and the same amount say that connectivity is important for protecting vehicles throughout the vehicle’s whole lifecycle.

OEMs are closely monitoring potential targets by hackers, such as interfaces and APIs, digital sims, infotainment systems and telematics.

49% of UK consumers do not think OEMs should be able to sell driver data to third parties as an additional revenue stream, compared to 44% globally. This is compared to 26% who think it’s fine and 20% (Global: 24%) who are ambivalent about it. However, fewer than one in five (18%) OEMs are currently selling data on. Japanese consumers are the least likely to disapprove of selling data on with 26% saying so. Americans are the most likely to disapprove, with 50% saying it should not be allowed.

Safety Features and Speed Limiting Technology

OEMs must navigate nuanced consumer sentiment on issues of safety regulation, but consumers broadly support safety features that ensure vehicle longevity and affordability. 49% of respondents would seek repair services within a week of noticing a warning light. The mean response was 1.5 weeks, with 19% saying they’d seek service within 2-4 weeks. In fact, 67% report they take their car in for necessary repairs as soon as possible when receiving a recall notice.

Ultimately, this highlights the industry opportunity for over-the-air (“OTA”) updates, to revolutionise consumer satisfaction, safety, and convenience by allowing automakers to address select performance needs without requiring physical vehicle inspections.

A third (33%) of OEMs indicated that they plan to implement speed limiting and anti-distraction technology in the next 3 years, including in countries, like the United States, where legislation does not yet require it. Although half (55%) of US drivers favour safety features like these being introduced as standard in new vehicles, a significant minority are against. In fact, if speed-limiting technology were introduced, 38% of Americans and Germans say they will buy a different car. This shows that the topic is divisive, and OEMs may face backlash from the public should they implement it.

Looking Ahead

The report showcases a nuanced, yet optimistic future for OEMs navigating a rapidly changing automotive landscape. The willingness to pay for digital services is increasing, particularly given the new generation of drivers that are digital natives and accustomed to connectivity.

For more information, you can find the Consumer and OEM Attitudes to Software-Defined Vehicles Report here.

About the Survey

Two surveys were conducted concurrently to understand and compare automotive executive and consumer attitudes towards SDVs.

- OEM methodology: Conducted between October and December of 2024 by Sapio Research. It evaluated 60 automotive executives.

- Consumer methodology: Conducted in September and October of 2024 by Sapio Research. It surveyed 8,000 adults aged 18+ across the UK, Germany, US and Japan.

About Cubic³

Cubic³ provides advanced connectivity solutions for software-defined vehicles (SDVs) across 200+ countries. We help automotive, agriculture and transportation OEMs navigate the complexities of connecting vehicles while ensuring compliance with global regulations. With access to over 550 mobile networks, our smart connectivity empowers OEMs to innovate, scale and unlock new opportunities, driving efficiency and growth.

Contacts

Press contacts

Fight or Flight for Cubic³

[email protected]

Tel: +44 330 133 0985