ZIONSVILLE, Ind.–(BUSINESS WIRE)–Delaware Life Insurance Company (“Delaware Life”), a Group 1001 company, announced today the launch of Target Income Choice™, a new fixed index annuity (FIA) available through the bank and broker-dealer channels. It provides a combination of guaranteed lifetime income, growth potential, and downside protection to further protect customers from rising inflation and market volatility.

Target Income Choice™, an enhanced version of one of Delaware Life’s core FIAs, Target Income 10®, empowers customers to personalize how they accumulate income for retirement, aligning with their unique financial goals and timelines.

Target Income Choice™ features include:

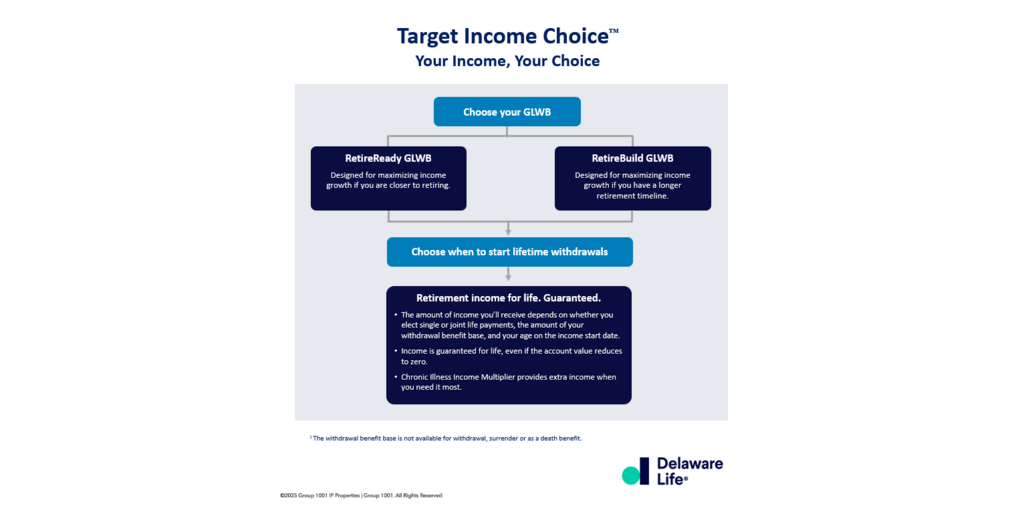

- Two guaranteed lifetime withdrawal benefit (GLWB) options: RetireReady GLWB maximizes income growth for customers closer to retirement, while RetireBuild GLWB maximizes income growth for customers with a longer retirement timeline.

- Guaranteed lifetime income payment factors: These factors increase with age and continue even if the account value reduces to zero.

- Chronic illness income multiplier: Customers can increase their annual withdrawal amount by up to 200% for five years1.

- Built-in flexibility: Customers can build a custom or pre-set allocation using world-class index strategies and can wait to take lifetime income to select single or joint payments2.

With an emphasis on a flexible design, Target Income Choice™ offers customers a pro-rated roll-up bonus credit to their withdrawal benefit base. This allows income to accumulate from the income start date and the ability to add money at any time3.

“Delaware Life is continuously reviewing its products to help ensure they meet both the needs of our financial professionals and the customers they serve,” said Dale Uthoff, Chief Product Officer of Group 1001. “The enhancements offered with Target Income Choice™ provide retirees and near-retirees with solutions that can help protect their retirement savings while offering growth potential.”

Amid increasing longevity, market volatility, and inflationary pressures, Target Income Choice™ is a strategic tool for building income plans.

“Backed by Delaware Life’s nearly 30 years of innovation, Target Income Choice™ empowers advisors to deliver clarity and confidence, helping ensure customers can achieve guaranteed, sustainable income and financial peace of mind,” said Colin Lake, President & CEO of Delaware Life Marketing. “Target Income Choice™ can provide substantial value to bank and broker-dealer advisors in effectively serving their customers’ financial objectives.”

For more information about how Target Income Choice™ can help address the needs of today’s retirees, visit our website.

|

1. Please note that AWA payments will lose the increase from the Chronic Illness Income Multiplier if the Account Value is reduced to zero. Once the AWA multiplier period ends, a new multiplier period is no longer available. The Chronic Illness Income Multiplier benefit may be used only one time per contract. AWA is 200% for single life and 150% for joint life for up to 5 years. |

|

2. Joint lifetime income is available at no additional cost. |

|

3. The upfront bonus is only applied to payments added in the first contract year. Additional payments made after the first 90 days are not included in the roll-up bonus base. |

|

Guarantees based on the financial strength and claims paying ability of the issuing insurance company. For use with Delaware Life Insurance Company base policy forms ICC22-DLIC-FIA, ICC25-DLIC-FIA-GLWB-BON, ICC25-DLIC-FIA-GLWB-NB and state-specific variations where applicable. Policy and rider form numbers may vary by state. Products, riders, and features may vary by state, and may not be available in all states. This material may not be approved in all states. Fixed index annuities are not stock market investments and do not directly participate in any stock or equity investments. |

About Delaware Life Insurance Company

Delaware Life is an insurance and annuity company that empowers financial professionals with a wide array of customizable solutions. A subsidiary of Group 1001 Insurance Holdings, LLC, our focus is to deliver a seamless experience for advisors. We understand how important it is to find the right fit for every client, every situation, and every individual need. We’re passionate about equipping you with annuities that give your customers peace of mind and a successful future—allowing them to plan with confidence for whatever’s next.

About Group 1001

Group 1001 Insurance Holdings, LLC (“Group 1001”) is a collective that empowers companies to create positive growth. Our insurance and annuities are easy to understand and accessible to all. Our online investing platform gives individuals control over their savings. Our technology and innovation help companies succeed. And our strategic partnerships bring people together through education and sports.

As of December 31, 2024, Group 1001 had more than 1,500 employees and combined assets under management of approximately $67.8 billion and currently provides over 496,000 active annuity contracts and life insurance policies. It comprises the following brands: Delaware Life, Gainbridge®, Clear Spring Life and Annuity Company, Clear Spring Property and Casualty Group, Clear Spring Health, and the RVI Group, among others.

Contacts

Amanda Vela

Group 1001

Social Media Manager

amanda.vela@group1001.com

317-374-3180