RESTON, Va.–(BUSINESS WIRE)–#identity—iCard, a leading European e-money institution, has successfully upgraded its customer checks with Regula’s advanced biometric and document verification technologies. By integrating Regula Face SDK and Regula Document Reader SDK with its KYC (Know Your Customer) and risk assessment systems, iCard has moved to speedy, automated verification with improved fraud detection, and enhanced the overall experience for customers in 30+ countries.

As a licensed fintech organization, iCard must comply with strict European KYC regulations while maintaining a robust risk assessment system alongside low-effort customer experience.

Prior to implementing Regula’s solutions, manual verification processes led to inefficiencies, longer wait times, increased fraud, and potential friction for users. Customers often had to re-upload photos or wait for manual reviews, causing delays—especially outside business hours. Additionally, iCard needed a more comprehensive document verification system that was capable of recognizing a broader range of ID types.

The Regula Solution: Fast and Fraud-Free Identity Verification

To modernize and automate its verification process, iCard selected Regula’s complete solution for document and biometric verification for its industry-leading accuracy, ease of integration, and ability to meet the company’s specific requirements.

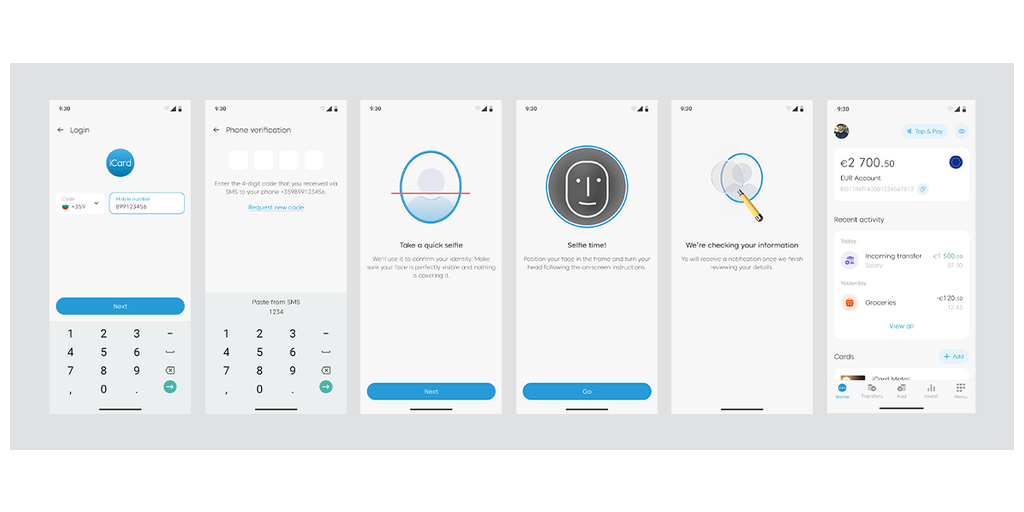

- Regula Face SDK: Integrated into the iCard Digital Wallet app (Android and iOS), it provides fast and reliable biometric verification when a user logs in or performs a money transaction. The solution conducts instant liveness detection and face matching, preventing fraud attempts, including presentation attacks, deepfakes, or injected videos.

- Regula Document Reader SDK: Deployed in iCard’s back-office system, it automatically authenticates ID cards, passports, and residence permits, including previously unsupported paper-based IDs. Regula’s solution reads and authenticates data from multiple document zones, including MRZs (machine-readable zones), RFID chips, and barcodes, and cross-validates the information to detect any inconsistencies that may indicate fraud.

Tangible Business Benefits

The project was completed in just one month, and the impact has been immediate:

- Instant identity verification – Customers can now authenticate their identity in under a minute.

- Reduced operational costs – Automated verification processes have minimized manual reviews.

- Enhanced fraud prevention – Advanced biometric and document verification strengthen security measures.

- Increased conversion rates – Faster verification leads to a smoother onboarding experience and reduced drop-off rates.

“Implementing Regula Face SDK and Regula Document Reader SDK has optimized our internal processes while ensuring a seamless experience for iCard Digital Wallet customers. The integration was completed in a short period, resulting in fast and secure identity verification, improved operational efficiency, and reduced fraud risks—all while boosting customer satisfaction,” says Gabriela Anastasova, Chief Product Officer at iCard.

“In today’s fintech landscape, balancing security and user convenience is critical. Customers expect seamless access, while businesses must comply with strict regulations and defend against sophisticated fraud. We are proud to support iCard in finding that perfect balance. Our solutions ensure that every identity check is robust, automated, and frictionless, allowing fintech innovators like iCard to scale securely and efficiently,” comments Ihar Kliashchou, Chief Technology Officer at Regula.

To learn more about how iCard optimized identity verification with Regula’s solutions, read the full case study on Regula’s website.

About iCard

iCard is a licensed e-money institution and a leader in the European fintech sector. With over 18 years of experience, we deliver innovative payment services to both individual and business clients. Our mission is to make financial convenience accessible to everyone. That’s why we dedicate our time and resources to creating solutions that empower people and businesses to take full control of their funds, while ensuring a seamless customer experience through secure, innovative, and hassle-free financial and technological services.

Learn more at www.icard.com.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security, or speed. Regula has been repeatedly named a Representative Vendor in the Gartner® Market Guide for Identity Verification.

Learn more at www.regulaforensics.com.

Contacts

Kristina – [email protected]