PERTH, Australia–(BUSINESS WIRE)–In accordance with the Listing Rules, please see attached announcement relating to the above, for release to the market.

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Forward-looking statements

This announcement contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding any transaction (including statements concerning the timing and completion of the transaction, the expected benefits of the transaction and other future arrangements between the parties) expectations regarding future expenditures and future results of projects. All forward-looking statements contained in this announcement reflect Woodside’s views held as at the date of this announcement. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’, ‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘forecast’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions.

Forward-looking statements in this announcement are not guidance, forecasts, guarantees or predictions of future events or performance, but are in the nature of aspirational targets that Woodside has set for itself and its management of the business. Those statements and any assumptions on which they are based are only opinions, are subject to change without notice and are subject to inherent known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective officers, directors, employees, advisers or representatives.

Details of the key risks relating to Woodside and its business can be found in the «Risk» section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review and have regard to these risks when considering the information contained in this announcement.

Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from those expressed in, or implied by, any forward-looking statements.

All information included in this announcement, including any forward-looking statements, speak only as of the date of this announcement and, except as required by law or regulation, Woodside does not undertake to update or revise any information or forward-looking statements contained in this announcement, whether as a result of new information, future events, or otherwise.

Chair and CEO Addresses: 2025 Annual General Meeting

Richard Goyder and Meg O’Neill

Thursday, 8 May 2025

Chair Richard Goyder

Good morning everyone, and a warm welcome to Woodside’s 2025 Annual General meeting.

I am informed that a quorum is present and formally declare the meeting open.

I also open the poll for voting on all items of business.

I would like to begin by acknowledging the Whadjuk people of the Noongar nation as the Traditional Custodians of the land on which we meet today, and pay my respects to Elders past and present.

For those in the room, please familiarise yourself with the evacuation procedures on the screen, which apply in the event of an emergency.

Today’s event is a valuable opportunity for Woodside’s Board and management to hear directly from our shareholders and respond to your questions.

I am joined on stage this morning by our Chief Executive Officer and Managing Director, Meg O’Neill, and Group Company Secretary, Damien Gare.

Every member of Woodside’s Board of Directors is also here in the room.

Nick Henry and Anthony Hodge, representing our auditors, PwC, are also present today.

After the meeting, shareholders are invited to join Directors and our Executive Leadership Team for light refreshments.

This year, we will take shareholder questions on all items of business in one question and answer session.

We want to give as many shareholders as possible an opportunity to be heard, although there may not be sufficient time to address all questions raised.

So please keep your questions brief, ask no more than two questions at a time, and avoid repeating issues or raising matters that have already been covered.

Only shareholders, their attorneys, proxies and authorised company representatives are entitled to speak and vote at this meeting.

Shareholders or proxyholders in the meeting room that would like to ask questions can do so by going to the question registration desk at the back of the meeting room. The question registration desk will remain open during the meeting and you may register your questions at any time.

You will then be called at the appropriate time to ask your question at the microphone stand.

If you have any mobility issues, please raise your hand for assistance with your question registration.

If you’re a shareholder or proxyholder joining online, please start submitting any questions now.

You can do this through the same platform you are watching the webcast on.

Instructions for submitting written questions online are shown on screen now, and instructions for submitting verbal questions online will be shown shortly.

Chair’s Address

On behalf of the Board, I would like to update you on Woodside’s strategies and our progress against those strategies.

Against a backdrop of geopolitical and market uncertainty, and a complex energy transition, investors are looking for Woodside to provide strategic clarity and resilience.

Our shareholders want confidence that when Woodside sets financial, project and sustainability targets, we have the plan and capability to deliver on them.

Our performance over the past year has demonstrated once again that this is the case.

Strong returns from our base business, disciplined cost management and the sell-downs of equity in our Scarborough Energy Project delivered full-year net profit after tax of US$3.6 billion, and underlying NPAT of US$2.9 billion.

This allowed us to once again return dividends to shareholders at the top end of our target payout range, with a 2024 full-year dividend of 122 US cents per share.

Indeed, since Woodside’s merger with BHP’s petroleum business in 2022, we have returned more than US$9.7 billion to our shareholders as dividends.

Our strong balance sheet enables us to continue rewarding shareholders during a period of higher capital expenditure, as we take forward the major projects that we are confident will deliver Woodside’s next wave of value creation.

Major projects under construction at Beaumont New Ammonia, Scarborough, Trion and Louisiana LNG will move into production over the next few years, transitioning Woodside from a capital-intensive phase to an extended period of substantial free cash flow.

As Meg noted last week when announcing our decision to take forward Louisiana LNG, we forecast Woodside’s annual portfolio sales volumes to be almost 50 percent higher in the 2030s than they are today, and annual net operating cash increasing to over US$8 billion in this period.

This would represent a step-change in value creation and provide us with additional options to reward our shareholders.

As these figures demonstrate, we reward investors today through strong dividends, while investing in a high-quality, diverse portfolio to create future value and position us to successfully navigate the energy transition.

Our shareholders will benefit from Woodside’s proven track record of operational excellence, world-class project delivery and financial discipline.

It is a combination that distinguishes Woodside among our peers, and takes on increasing importance in the current global environment.

The larger, more diverse and resilient Woodside that emerges by the end of this decade will be well positioned to deliver enduring shareholder value as the energy transition unfolds.

We are determined for Woodside to play a constructive role in the global response to climate change, and are taking meaningful steps to achieve this.

At the same time, our climate strategy is well suited for current political and market realities, which indicates the energy transition is likely to unfold in a way that is not linear or uniform across the globe.

We are operating a complex business and making significant decisions in a time of geopolitical uncertainty, with the energy transition central to that.

While the importance of decarbonising the world to mitigate the impacts of climate change is not debated, the how is.

It is not a simple task to provide reliable, affordable and zero emissions energy to consumers and businesses within a short period of time.

And it is made all the harder when opportunities to achieve real emissions reduction – from coal-to-gas switching, or carbon capture and storage – are taken off the table.

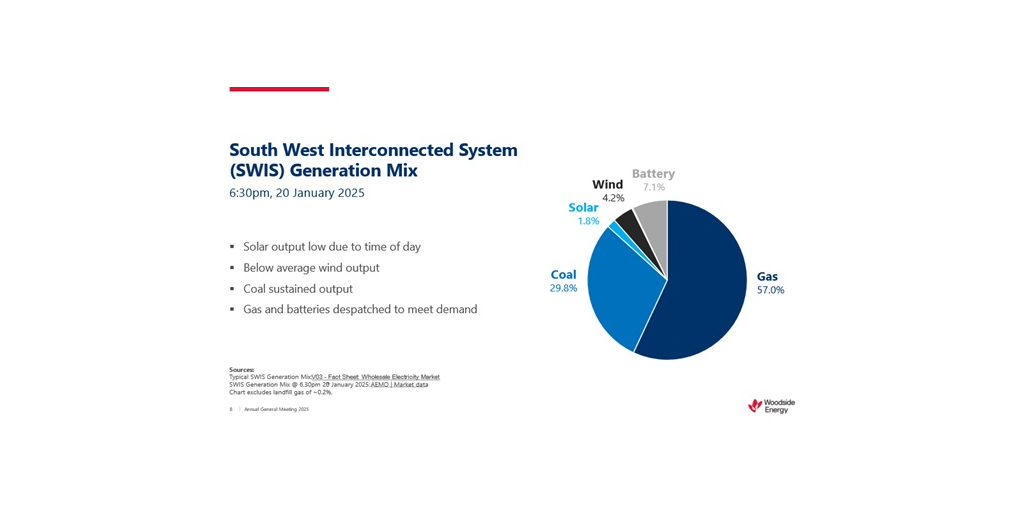

Right now, in Australia, approximately 60 percent of power generation comes from coal and gas.

In the past couple of weeks, the Australian Energy Market Operator and large energy users in Australia have all made the case that gas will continue to be an important part of the energy mix for many years to come.

The accompanying chart helps to show why. At 6:30pm on a hot summer’s day in Western Australia there is very little wind, the sun is setting and peak energy demand has kicked in.

Gas has been despatched to meet demand, providing more than half of the power needed to keep lights on and air-conditioners running.

So, it is not easy. Renewables are growing, but there are real costs to integrate these into systems, and of course, reliability issues.

Investors, manufacturers and consumers need an open and honest approach to the energy transition, including what the trade-offs will be and how it may impact them.

Australia needs an energy policy which is clear in its commitment to net zero by 2050, but also achieves affordability and reliability, maintaining our domestic energy advantage and significant export income.

Full implementation of the Albanese Government’s Future Gas Strategy can play a key role in this approach, by supporting energy security and decarbonisation in Australia and our region.

Woodside’s approach balances ambition with discipline and achievability. Importantly, we only set targets where we have identified a pathway to meet them.

We have not walked back from our climate targets and commitments. As outlined in our 2024 Climate Update, we are making good progress towards the targets we have set.

We will of course continue listening to our shareholders, who have diverse views, and take your feedback into account as we evolve our approach.

Woodside’s Board and management held more than 250 climate-related meetings with investors during 2024, and you have my undertaking that we will continue our meaningful engagement on this important topic.

As we set the strategic framework for Woodside to deliver enduring value through the energy transition, we are ensuring the Board has the right balance of expertise, experience and tenure to keep pace with our growing footprint and broader range of activities.

Woodside has been actively renewing the membership of the Board, appointing six directors since 2020 with significant professional experience in our industry and other relevant fields.

We are balancing this with the continuity and corporate memory provided by our longer-serving directors.

The three directors offering themselves for re-election or election today – Ann Pickard, Ben Wyatt and Tony O’Neill – bring complementary skills and experience that collectively strengthen our Board, and I commend Ann, Ben and Tony to you.

We are also fortunate to have a skilled and dedicated executive team that is led superbly by our Chief Executive Officer Meg O’Neill.

I would like to thank Meg and everyone at Woodside for another outstanding year.

I would also like to thank you, our shareholders, for continuing to put your trust in Woodside.

I am confident the decisions we are taking today will reap significant long-term benefits for our shareholders, as we build a resilient, cash-generative business that is well positioned to deliver enduring value through the energy transition.

As I hand over to Meg, please take a moment to watch this video highlighting our achievements over the past year.

CEO and Managing Director Meg O’Neill

Hello everyone, and thank you for joining us in person and online.

Watching that video is a great reminder of our many achievements since we met in this room a year ago. It also signals the transformative period underway as we lay the foundations for Woodside’s next chapter of growth and value.

As Richard noted, our shareholders can have confidence in Woodside’s considered, disciplined strategy to thrive through the energy transition.

You can be equally assured that we are delivering against all elements of this strategy – by providing energy to meet growing demand, creating and returning shareholder value, and conducting our business sustainably.

We are doing what we say we will do, meeting our commitments to customers, investors and the broader community.

Woodside’s operational excellence has been on full display over the past year, with record annual production driven by strong reliability at our Australian LNG assets and outstanding early performance from our Sangomar Project.

Just as pleasing has been our ability to match increased production with reduced unit operating costs, a great achievement given inflationary pressures in Australia and globally.

While delivering this strong performance across our base business, we are also executing all of our major growth projects to budget and schedule.

These include our Scarborough Energy Project offshore Western Australia, which is now more than 80% complete and on track for first LNG cargo in the second half of 2026.

Scarborough is one of the most cost-competitive LNG projects under construction. With near zero reservoir CO2 and efficient facilities, Scarborough LNG will also be one of the lowest carbon intensity LNGs delivered to customers in north Asia. It has already attracted quality customers and joint venture partners that will underpin its value to Woodside shareholders for years to come.

The decision by major Japanese energy companies JERA and LNG Japan to take equity in Scarborough demonstrates they share Woodside’s confidence in long-term demand from this world-class project.

We are making equally good progress on our Trion Project offshore Mexico, which is now more than 25 percent complete and on track for first oil in 2028.

By the time Trion starts production, we will also be well progressed towards the first cargo from our Louisiana LNG Project on the US Gulf Coast, on which we took a final investment decision last week.

Louisiana LNG is a game-changer for Woodside, positioning our company as a global LNG powerhouse capable of delivering enduring shareholder returns.

By adding Louisiana LNG to our established Australian LNG business, Woodside expects to be delivering approximately 24 million tonnes of LNG each year in the 2030s, and operating more than five percent of global supply.

We will be able to serve a growing global base of customers across the Pacific and Atlantic basins, as demand for energy from secure, reliable suppliers like Woodside continues to increase.

Since early 2024 we have signed long-term agreements with major energy customers in Asia and Europe for supply of more than 45 million tonnes of LNG from Woodside’s global portfolio.

Contracts signed during the past two months with China Resources and Uniper will see Woodside’s LNG delivered into China and Europe into the 2040s.

This demonstrates robust long-term demand for our core product as countries around the world seek to meet both their energy security needs and decarbonisation goals.

The ability of gas to provide reliable baseload power, at half the lifecycle emissions of coal, makes it ideally suited for this dual purpose.

Our strong balance sheet allows us to invest in new value-creating growth projects, while also returning value to shareholders today.

As Richard noted, in 2024 we once again delivered a full-year, fully franked dividend at a payout ratio of 80%. This continues our decade-long track record of paying shareholder dividends at the top end of our range.

In recent months we have streamlined our portfolio through an agreed Australian asset swap with Chevron, and divestment of our producing assets in Trinidad and Tobago. We have also reduced our 2025 spend across exploration and new energy by more than US$150 million.

This demonstrates our consistent, disciplined approach to capital allocation.

Strong sustainability performance is at the core of how Woodside builds and operates our business.

We are delivering on our climate strategy, remaining firmly on track to meet our 2025 and 2030 net equity Scope 1 and 2 emissions reduction targets.

Our acquisition of the Beaumont New Ammonia Project, on which construction is now more than 90 percent complete, represents a step-change towards achievement of our Scope 3 investment and abatement targets.

Beaumont is one of the world’s first ammonia plants paired with auto thermal reforming, delivering 95 percent carbon dioxide capture. We are targeting first ammonia production from Beaumont later this year, with lower-carbon ammonia targeted for the second half of 2026.

This provides Woodside with first mover advantage in a growing global market, and we expect the project to be free cash flow accretive from next year.

On safety, we are seeing positive results against key metrics. Our growing business saw a large increase in total hours worked in 2024, without experiencing any permanent injuries or Tier 1 process safety events.

Finally, we continue to demonstrate that when Woodside does well, the communities where we operate benefit significantly through jobs, revenue and business opportunities.

In Australia, we remain a key supplier of reliable and affordable energy to homes and businesses. During 2024 we made extra supplies of domestic gas available, supporting energy security and meeting ongoing customer demand.

This included executed sales of 77 Petajoules in east coast Australia for local manufacturing, agribusiness and energy retailers. In Western Australia, we executed domestic gas sales of 73 Petajoules for delivery to mining, industrial and retail energy customers.

We injected US$7.9 billion into local economies through purchase of goods and services in 2024, with US$5.1 billion of this spent in Australia.

We are also one of the largest taxpayers in Australia, contributing A$4.1 billion in taxes, royalties and levies in 2024.

I would like to thank everyone at Woodside for their efforts over the past year, and their ongoing focus through this transformative period for our company. I am very proud to lead such a capable, dedicated team.

I would also like to echo Richard’s thank you to our shareholders. We value your ongoing investment and appreciate your constructive engagement.

As we continue building a successful, sustainable Woodside, I have never been more confident in our ability to provide energy to a world that needs it now and into the future.

Contacts

INVESTORS

Sarah Peyman

M: +61 457 513 249

E: [email protected]

MEDIA

Christine Forster

M: +61 484 112 469

E: [email protected]